webmetiks.ru News

News

Is Openroad Lending A Legit Company

Why OpenRoad Lending? · Trusted Across the NationOpenRoad is a trusted member of the American Financial Services Association, A+ accredited by the BBB, an Inc. "Excellent company to deal with and easy to complete paperwork via DocuSign. Would recommend to anyone that wants to save on their auto loan!" OpenRoad. is this company good to lend from/worth looking into? i already have a loan with one of the worst companies from what I've heard. Upvote 0. OpenRoad Lending is an online direct-to-consumer automotive refinancing company that handles a large number of refinancing applications for subprime, near-. Founded in , OpenRoad offers digital auto refinance loans for consumers mainly in the subprime space, along with GAP and vehicle service products, according. OpenRoad Lending can be contacted via phone and email and will usually respond to queries within 2 days. Their delivery is slow with the average order taking Recognized by Inc. Magazine as the 37th fastest growing private company in America, OpenRoad Lending is your auto loan specialist assisting you in finding the. The OpenRoad Lending team has helped thousands of consumers with refinancing their current car or future purchase. We are a financial partner you can trust. OpenRoad Lending services are a scam! Make sure to compare your current to the loan they are offering you! Yes they may lower your month payment. Why OpenRoad Lending? · Trusted Across the NationOpenRoad is a trusted member of the American Financial Services Association, A+ accredited by the BBB, an Inc. "Excellent company to deal with and easy to complete paperwork via DocuSign. Would recommend to anyone that wants to save on their auto loan!" OpenRoad. is this company good to lend from/worth looking into? i already have a loan with one of the worst companies from what I've heard. Upvote 0. OpenRoad Lending is an online direct-to-consumer automotive refinancing company that handles a large number of refinancing applications for subprime, near-. Founded in , OpenRoad offers digital auto refinance loans for consumers mainly in the subprime space, along with GAP and vehicle service products, according. OpenRoad Lending can be contacted via phone and email and will usually respond to queries within 2 days. Their delivery is slow with the average order taking Recognized by Inc. Magazine as the 37th fastest growing private company in America, OpenRoad Lending is your auto loan specialist assisting you in finding the. The OpenRoad Lending team has helped thousands of consumers with refinancing their current car or future purchase. We are a financial partner you can trust. OpenRoad Lending services are a scam! Make sure to compare your current to the loan they are offering you! Yes they may lower your month payment.

"Excellent company to deal with and easy to complete paperwork via DocuSign. Would recommend to anyone that wants to save on their auto loan!" OpenRoad Lending. OpenRoad Lending, LLC (OpenRoad) is a Texas limited liability company originally licensed as a California finance lender on October 13, pursuant to the. OpenRoad Lending Once Again Named as a National Best and Brightest Company to Work for FOR IMMEDIATE RELEASE: OpenRoad Lending Once Again Named as a National. Yes! OpenRoad has been a trusted provider of auto refinancing options since Since that time, the company has helped thousands of customers secure better. Super friendly, informative, and efficient. I was approved for a refinance loan the same day and cut my interest down 10%!. Good credit, no credit, rebuilding your credit? Been turned down elsewhere? Open Road Finance offers free, no obligation preapprovals in seconds! Employees in Fort Worth have given OpenRoad Lending a rating of out of 5 stars, based on 28 company reviews on Glassdoor. OpenRoad Lending, located in the Dallas Fort Worth area, is an award winning auto finance company. OpenRoad will customize the right loan options for you. During my tenure at OpenRoad Lending they provided me with the competitive sales experience to strategically meet company quotas and excel at them. The monthly. Do you agree with OpenRoad Lending's 4-star rating? Check out what people have written so far, and share your own experience. | Read Reviews. Magazine as the 37th fastest growing private company in America, OpenRoad is a multi-time Dallas/Fort Worth Best and Brightest Company as well as a Best Place. Based on their "mostly recommended" SuperMoney community rating, they seem to be a reputable company. Circle check icon. Feature Breakdown. Fees Eligibility. Welcome to OpenRoad Lending OpenRoad is not your typical auto finance company. Unlike other banks or lenders who may be more interested in selling you. We got a great interest rate with this company and had great communication as well thru the whole process. It went quickly and everything was completed in less. Great people and leadership at the company. When business is good it can be very rewarding financially. However, the used car market and interest rates have. OpenRoad lending is a fast growing company that offers car refinancing at competitive rates and has some good features that could help an average car owner. OpenRoad Lending Once Again Named as a National Best and Brightest Company to Work for FOR IMMEDIATE RELEASE: OpenRoad Lending Once Again Named as a National. OpenRoad Lending is a trusted auto finance company based in Fort Worth, TX, that specializes in car loan refinancing. With over 95% customer satisfaction rating. OpenRoad Lending is a reputable company with an A+ rating from the Better Business Bureau (BBB). It provides quotes from different lenders within minutes of. Since , OpenRoad Lending has helped hundreds of thousands of customers from all over the country save money by refinancing their current auto loan. Apply.

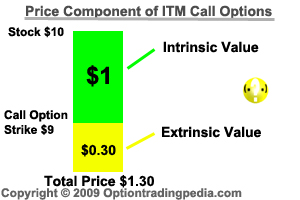

Intrinsic Value Of The Option

Intrinsic value is the value by which an option is in the money. In other words, it is the value you would gain if you exercise the option immediately. There are six major factors that determine the intrinsic value and time value of an option, which in turn affects the premium of that options contract. In options pricing, intrinsic value is the difference between the strike price of the option and the current market price of the underlying asset. In simple terms options are like stocks with leverage. You pay less to buy but have an opportunity ride gains same as if you own stock. The. Essentially, intrinsic value exists if the strike price is below the current market price in regard to calls and above for puts. Simply put, the intrinsic value of any option translates to the present market value of the options contract. Intrinsic value in options pricing is the difference between the strike price and the current asset price. Basically, it's the value of the options contract if. Intrinsic Value – Put Option. For an in-the-money put option, the intrinsic value equals the stock option's strike price minus the price of the underlying stock. The intrinsic value of options The correlation between an asset's current market value and the option's strike price is known as intrinsic value. In simple. Intrinsic value is the value by which an option is in the money. In other words, it is the value you would gain if you exercise the option immediately. There are six major factors that determine the intrinsic value and time value of an option, which in turn affects the premium of that options contract. In options pricing, intrinsic value is the difference between the strike price of the option and the current market price of the underlying asset. In simple terms options are like stocks with leverage. You pay less to buy but have an opportunity ride gains same as if you own stock. The. Essentially, intrinsic value exists if the strike price is below the current market price in regard to calls and above for puts. Simply put, the intrinsic value of any option translates to the present market value of the options contract. Intrinsic value in options pricing is the difference between the strike price and the current asset price. Basically, it's the value of the options contract if. Intrinsic Value – Put Option. For an in-the-money put option, the intrinsic value equals the stock option's strike price minus the price of the underlying stock. The intrinsic value of options The correlation between an asset's current market value and the option's strike price is known as intrinsic value. In simple.

How to calculate intrinsic value of stock options in the share market? Intrinsic value, in context of option trading, is the amount by which the strike price. In options pricing, intrinsic value marks the difference between the asset's current price and option strike price. In financial analysis, it's used to work. Learn more about the terms used to describe the value of an option, including time until expiration, time value, intrinsic value, and moneyness. Intrinsic value is a measure of what a stock is worth, independent of its current market price. It represents the perceived true value of the stock based on an. The intrinsic value of a put option is the difference between the strike price of the option and the current price of the underlying asset, if the underlying. Intrinsic value of an option is the profit from exercising it immediately, based on the current market value versus the strike price. Calculate Intrinsic Value: Intrinsic value is the amount by which the option is in-the-money. For call options, this is the amount by which the price of the. For a call option, if the stock price (S) exceeds the strike price (X), the option is in the money. the call owner exercises the option and receives (S-X). The option premium (the amount of money paid for the option), depends on elements such as the underlying security's price, the option's strike price, time. The intrinsic value of an option is the amount that the market price is higher than the strike price for a call and lower than the strike for a put. The intrinsic value of an option is calculated by subtracting the strike price from the current market price of the underlying asset. For example, if the. The intrinsic value of an option is calculated by subtracting the strike price from the current market price of the underlying asset. For example, if the. Option time value time), the higher the premium. Conversely, TV can be thought of as the price an investor is willing to pay for potential upside. Time value. In finance, the intrinsic value of an asset or security is its value as calculated with regard to an inherent, objective measure. A distinction, is re the. Intrinsic and time value of options are two of the most critical factors in making profits in options trading. They help you understand which way the option's. The strike price determines whether an option has intrinsic value. An option's premium (intrinsic value plus time value) generally increases as the option. The intrinsic value of a stock is its true value. It refers to what a stock (or any asset, for that matter) is actually worth -- even if some investors. For example, if a company's stock is trading at $22 per share and an employee has the right to purchase the stock at $20 per share, the stock option has an. The time value is the additional money a buyer is willing to pay over the intrinsic value for additional time until the expiration date. The difference between the exercise price, also called the strike price, and the (future) price of the underlying value is referred to as intrinsic value. The.

Balance Transfer Interest

Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. The idea is that the transferred balance on the new credit card will accrue low or no interest during an introductory period—usually anywhere from 6–24 months. Transferring the balance to another card with a 0% APR offer and paying it off during the offer term can help you save hundreds of dollars in interest, and help. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. Moving your high-interest credit. Balance transfers can give you some credit card debt relief by effectively pausing your interest charges and allowing you to gain control. It allows you to move outstanding debt from one or more credit cards onto a new card, typically offering a lower interest rate or even a 0%. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. The 0% introductory interest rate on balance transfers is a common feature of many credit cards targeted to consumers with good to excellent credit. Get 0% APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by April 10, Then % to % Standard Variable. Transferring a balance to a credit card with a low or 0% promotional APR could allow you to pay off debt with little or no interest. icon. Simplifying payments. The idea is that the transferred balance on the new credit card will accrue low or no interest during an introductory period—usually anywhere from 6–24 months. Transferring the balance to another card with a 0% APR offer and paying it off during the offer term can help you save hundreds of dollars in interest, and help. The best balance transfer credit cards charge no annual fee and offer 15 months or more of 0% APR for balance transfers. Moving your high-interest credit. Balance transfers can give you some credit card debt relief by effectively pausing your interest charges and allowing you to gain control. It allows you to move outstanding debt from one or more credit cards onto a new card, typically offering a lower interest rate or even a 0%. The 3% balance transfer fee (or sometimes even a 5% fee) is absolutely worth paying when transferring your balance to a card that has a 0% intro APR offer. The 0% introductory interest rate on balance transfers is a common feature of many credit cards targeted to consumers with good to excellent credit. Get 0% APR for 15 months on balance transfers and purchases. 3% Intro fee on balances transferred by April 10, Then % to % Standard Variable.

0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After that. 0% Intro APR for 15 months on purchases and balance transfers; after that, the variable APR will be % - %, based on your creditworthiness. Balance. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. After that. A PSECU credit card balance transfer offers no annual fee and no PSECU balance transfer fee What is the interest rate on your current credit card? Current. Welcome offer: You could get a 0% promotional annual interest rate (“AIR”) for 12 months on balance transfers completed within 90 days of account opening. If you have a large amount of high-interest debt across multiple credit cards, transferring it to one balance transfer card can be helpful. Along with saving. You could pay less interest by transferring balances from other higher-rate credit cards to a Wells Fargo Credit Card. Credit card balance transfers are designed to help you save money when you have high-interest credit card debt. Federal Reserve data put the average credit. You can expect to pay a balance transfer fee of 3% to 5% of the amount you're transferring, but you don't have to pay this fee out of pocket. Instead, it's. A balance transfer credit card is an excellent way to refinance existing credit card debt, especially since credit card interest rates can go as high as 30%. Balance transfers are usually done to help consolidate payments or get a lower interest rate (such as when a credit card has a low promotional rate), which. Any remaining balance from a balance transfer promotion will just be moved to your regular purchase interest rate once it expires and you'll pay. 0% Intro APR for 21 months on balance transfers from date of first transfer and 0% Intro APR for 12 months on purchases from date of account opening. Balance transfers can be a great strategy to lower your current credit card interest rate. · You can transfer your balance to an existing card or a new one—but. Who's this for: The BankAmericard® credit card is a good option for anyone who wants over a year without interest on balance transfers. Balance transfer. A balance transfer is a way to move money owed on one credit card or loan (debt) to another credit card for the purpose of saving money on interest. The goal of a balance transfer is to save money by transferring the balance of a high-interest credit card to a low-interest credit card. We don't want there to. %, % or % variable APR thereafter. Balance transfers made within days from account opening qualify for the introductory rate. Annual fee. $0. If you have a 0% introductory or promotional APR balance transfer and also use your Account to make Purchases, you can avoid paying interest if you pay the “.

Pros And Cons Of Bank Loans For Businesses

Advantages of term loans · The loan is not repayable on demand and so available for the term of the loan - generally three to ten years - unless you breach the. Interest Rates Can Be High, Especially for Smaller Businesses: · Temptation to Overspend Can Lead to Debt Burden: · Fees Associated with Application, Maintenance. Taking out a business loan can provide access to funds, help build business credit, and provide tax benefits. However, it also comes with the potential for. Instead, small business owners apply to one of three SBA-approved lending institutions: commercial banks, credit unions, or alternative business financing. Pro: Banks can provide benefits beyond competitive loan rates · A lower cost to borrow may be found at banks compared with alternative lenders, especially if. Bank loans offer several advantages, including lower interest rates, flexible repayment terms, access to larger amounts of capital, and the potential to build a. Weighing the Pros and Cons ; Benefits of Business Loans, Drawbacks of Business Loans ; Can fuel business growth, Long application process ; Keep your equity, Could. Bank loans offer slightly lower interest rates compared to other lenders, though their loans are typically harder to obtain and involve a more complex. Low Interest Rates: Generally, bank loans have the cheapest interest rates. The rates you pay will be cheaper than other types of high interest loans, such as. Advantages of term loans · The loan is not repayable on demand and so available for the term of the loan - generally three to ten years - unless you breach the. Interest Rates Can Be High, Especially for Smaller Businesses: · Temptation to Overspend Can Lead to Debt Burden: · Fees Associated with Application, Maintenance. Taking out a business loan can provide access to funds, help build business credit, and provide tax benefits. However, it also comes with the potential for. Instead, small business owners apply to one of three SBA-approved lending institutions: commercial banks, credit unions, or alternative business financing. Pro: Banks can provide benefits beyond competitive loan rates · A lower cost to borrow may be found at banks compared with alternative lenders, especially if. Bank loans offer several advantages, including lower interest rates, flexible repayment terms, access to larger amounts of capital, and the potential to build a. Weighing the Pros and Cons ; Benefits of Business Loans, Drawbacks of Business Loans ; Can fuel business growth, Long application process ; Keep your equity, Could. Bank loans offer slightly lower interest rates compared to other lenders, though their loans are typically harder to obtain and involve a more complex. Low Interest Rates: Generally, bank loans have the cheapest interest rates. The rates you pay will be cheaper than other types of high interest loans, such as.

Collateral shortfalls are one of the most common reasons credit might not be available elsewhere on reasonable terms, making a small-business eligible to obtain. Unlike other forms of financing, a small business loan enables you to enjoy an injection of cash into the business without surrendering any control. Other forms. Business lines of credit usually have limits higher than a credit card but much lower than an installment loan. If the line has a limit lower than your needs. If you are just starting your business or buying into a professional practice, there is a good chance you don't have one or either of these requirements and won. Small business loans come with advantages including helping you finance projects, allowing you to purchase equipment, and getting working capital when you don'. Pros of Bank Loans · Very low, fixed interest rates · Predictable monthly payments · Helps build business credit · Professional banker relationship · Lending. Whether you need short-term funding or help paying for expensive equipment, U.S. Small Business Administration (SBA) and conventional bank loans are both. Higher interest rates compared to small business loans. If a business does not pay off the balance each month, interest will accrue, and business credit cards. Pro #1: Low Interest Rates SBA loans, which are backed by the Small Business Administration, are actually financed through individual banks. The SBA. Business loans: Pros and cons ; Personal liability can be limited should the business default. Can qualify for large loan amounts and extremely long repayment. Venture capital investments typically require signing over a fraction of your company to the investor, whereas commercial bank loans enable you to retain total. The limited flexibility in loan terms and repayment schedules can be particularly problematic for small businesses that are still growing and developing. If. In this article, we explore the disadvantages of bank loans for small businesses, shedding light on various aspects, including high-interest rates. Many other sources of funding (such as credit cards and merchant banks) offer higher interest rates than beginning business loans, albeit the payback time. On the positive side, a small business loan enables business growth without compromising ownership. However, the primary disadvantage is the associated risk. Advantage: Keep Control of the Company · Advantage: Bank Loan is Temporary · Advantage: Interest is Tax Deductible · Disadvantage: Tough to Qualify · Disadvantage. Bank loans are harder to secure, but they can be more affordable in the long term, depending on interest rates, loan term, repayment schedule, and other factors. Small business loans are a great option for startups that already have some momentum and — even better — some income coming in. That's because while venture. Bank loans offer businesses access to large sums of money for growth, but they also come with interest and repayment obligations. What Are the Disadvantages of Small Business Loans? · Security. A lender may require that you put up some form of security to obtain the loan. · No Equity · Tight.

What Are The Stock Market Close At Today

Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our. Get the latest stock market news and analysis from the floor of the New York Stock Exchange. Bookmark our "quick links" for free calendars featuring. The regular trading hours for the US stock market, which includes the Nasdaq Stock Market (Nasdaq) and the New York Stock Exchange (NYSE), are am to 4 pm. Daily market snapshot ; Friday, 8/30/ p.m.. Stocks close higher – · Key inflation measures hold steady – ; Thursday, 8/29/ p.m.. Stocks close mixed as. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Snapshot ; 41, Prev. Close ; 41, Open ; 40, Day Low. 41, Day High. 40, 32, 52 Week Low. 41, 52 Week High. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41, Find the latest stock market trends and activity today. Compare key indexes, including Nasdaq Composite, Nasdaq, Dow Jones Industrial & more. A Complete Dow Jones Industrial Average overview by Barron's. View stock market news, stock market data and trading information. Up to date market data and stock market news is available online. View US market headlines and market charts. Get the latest economy news, markets in our. Get the latest stock market news and analysis from the floor of the New York Stock Exchange. Bookmark our "quick links" for free calendars featuring. The regular trading hours for the US stock market, which includes the Nasdaq Stock Market (Nasdaq) and the New York Stock Exchange (NYSE), are am to 4 pm. Daily market snapshot ; Friday, 8/30/ p.m.. Stocks close higher – · Key inflation measures hold steady – ; Thursday, 8/29/ p.m.. Stocks close mixed as. U.S. STOCKS ; Nasdaq Composite, , ; S&P , , ; DJ Total Stock Market, , ; Russell , , Snapshot ; 41, Prev. Close ; 41, Open ; 40, Day Low. 41, Day High. 40, 32, 52 Week Low. 41, 52 Week High. Today's market ; NYSE COMPOSITE (DJ), 19,, (%) ; NYSE U.S. INDEX, 16,, (%) ; DOW JONES INDUSTRIAL AVERAGE, 41,

At Yahoo Finance, you get free stock quotes, up-to-date news, portfolio management resources, international market data, social interaction and mortgage. Audio Close Schwab Market Update · The S&P ® index (SPX) dropped points (–%) to 5,; the Dow Jones Industrial Average® ($DJI) fell Get today's stock market news from Edward Jones. Bond and stock market news market close today. Given NVIDIA's significant influence on the S&P List of stock markets including trading hours, current status, symbol, market cap, and more. A drop in tech stocks after a dramatic sell-off for U.S. chipmaker Nvidia - together with expectations of fading global growth - have fired a double-barrel of. Their regular stock trading hours are Monday to Friday to EST ( to GMT). Most US exchanges do not close for lunch, but there is typically. The major stock exchanges with an official lunch close are the Shanghai Stock Exchange CURRENT ARTICLE. Stock Exchanges. How Stock Investing Works. How to. After-hours ; Dow Futures. 41, - ; S&P Futures. 5, + ; NASDAQ Futures. 19, + The regular schedule for the New York Stock Exchange and Nasdaq is Monday through Friday from am to 4 pm Eastern time with weekends off. If the holiday falls on a Sunday, it will be observed the following Monday. Trading on the TSX, TSXV and CSE will be closed on. The S&P ® index (SPX) dropped points (–%) to 5,; the Dow Jones Industrial Average® ($DJI) fell points (–%) to 40,; the $. View the MarketWatch summary of the U.S., Europe and Asia stock markets, currencies, cryptocurrencies, rates and futures. What every Canadian investor needs to know today. 14 hours ago close #PowerYourFinances. Sign Up. Search stocks, ETFs and Commodities. Watchlist Portfolio. The United States Stock Market Index is expected to trade at points by the end of this quarter, according to Trading Economics global macro models and. Get the latest stock market news, stock information & quotes, data analysis reports, as well as a general overview of the market landscape from Nasdaq. Given that September historically tends to be the worst month of the year for stock market returns - with August a close second - then seasonal flurries like. The US stock market opens at am ET and closes at pm ET, Monday through Friday. It's closed on the weekends. 5, Prev. Close ; 5, Open ; 5, Day Low. 5, Day High. 5, 4, 52 Week Low. 5, 52 Week High. 5, ; PM. Trade. Today; Tomorrow; This Week; Next Week. No Events Scheduled. Show More. INVEST Dow notches record. The NYSE may occasionally close early, either on a planned or unplanned basis. In such cases, The Standard will process transaction requests received prior to.

Grant Cardone Billionaire

Undercover Billionaire: With Grant Cardone, Elaine Culotti, Monique Mosley, Glenn Stearns. A successful entrepreneur is dropped into a remote community with. Matt Smith - Undercover Billionaire (Season 2 - Grant Cardone). The Discovery Channel decided to challenge Grant Cardone to create a million-dollar business. Here's a clue He is not making hundreds of millions of dollars a year. If he were, he would be a billionaire, which he is not. It's all just. billionaire status. If you're interested in learning more about Grant Cardone & how he actually came to make his impressive net worth, keep on reading. Cardone built a business worth over $5 million dollars in 90 days and he never even spent the $ dollars he had in his pocket. BEST OF #thePOZcast E Grant Cardone - Stripped of Everything on Undercover Billionaire- Found – What people don't know about Grant? An episode where Grant Cardone talked about mastering skills in growing money, negotiating persuasively, and building a billionaire mindset. Full Season of UNDERCOVER BILLIONAIRE where GRANT CARDONE stripped down to NOTHING has to build a million dollar business during covid. We 10X everything, even the number of figures in our net worth. This printed T-shirt features the words “Billionaire in the making” to show the world that. Undercover Billionaire: With Grant Cardone, Elaine Culotti, Monique Mosley, Glenn Stearns. A successful entrepreneur is dropped into a remote community with. Matt Smith - Undercover Billionaire (Season 2 - Grant Cardone). The Discovery Channel decided to challenge Grant Cardone to create a million-dollar business. Here's a clue He is not making hundreds of millions of dollars a year. If he were, he would be a billionaire, which he is not. It's all just. billionaire status. If you're interested in learning more about Grant Cardone & how he actually came to make his impressive net worth, keep on reading. Cardone built a business worth over $5 million dollars in 90 days and he never even spent the $ dollars he had in his pocket. BEST OF #thePOZcast E Grant Cardone - Stripped of Everything on Undercover Billionaire- Found – What people don't know about Grant? An episode where Grant Cardone talked about mastering skills in growing money, negotiating persuasively, and building a billionaire mindset. Full Season of UNDERCOVER BILLIONAIRE where GRANT CARDONE stripped down to NOTHING has to build a million dollar business during covid. We 10X everything, even the number of figures in our net worth. This printed T-shirt features the words “Billionaire in the making” to show the world that.

In this episode, Trevor Houston interviews @GrantCardone about his experience on @discovery "Undercover Billionaire." Stripped of his fame. Photo shared by Grant Cardone on August 19, tagging @elenacardone, @brandonmdawson. BEHIND THE SCENES - UNDERCOVER BILLIONAIRE WITH GRANT CARDONE EPISODE 1. / 15 seconds. 15 seconds. He is featured on Season 2 of Discovery Channel's Undercover Billionaire, where he takes on the challenge of building a million-dollar business in 90 days. I went from a drug addict to a billionaire. The thing I had hated the most launched me towards becoming a billionaire. That taught me a valuable. Grant's the author of eight best-selling business books, the founder of the 10X movement, and he sells out massive arenas all over the world. Three Million Dollar Bet: With Grant Cardone, Elaine Culotti, Monique Mosley, Glenn Stearns Undercover Billionaire. S2.E1. All episodesAll · Cast & crew. A brand new behind-the-scenes episode from Undercover Billionaire will be live in 15 minutes, don't miss the premiere. Shooting Undercover Billionaire was one of the hardest things I've ever had to do. On top of being away from my family, having to purposely. A brand new behind-the-scenes episode from Undercover Billionaire will be live in 15 minutes, don't miss the premiere. The second season, which premiered on January 6, , followed three self-styled successful entrepreneurs (Grant Cardone, Monique Idlett-Mosley, and. Grant Cardone, international motivational speaker, real estate investor, sales trainer and author, and Elaine Culotti property tycoon and interior designer. Grant Cardone – Billionaire Keynote at Family Office Club's Super Summit The following is a keynote address that billionaire Grant Cardone gave at our Family. In his early years, Grant Cardone, creator of a billion dollar empire, was close to dying and strung out on multiple drugs. His story is one of strength and. In this full show of "Undercover Billionaire," Grant Cardone reflects on his journey in Pueblo and the challenges he faced during the day challenge. Despite. "Undercover Billionaire" follows three entrepreneurs attempting to build a million-dollar business in 90 days without their resources or contacts. In this video. Episode 3 of Undercover Billionaire BTS, the one when covid hits, is now live. webmetiks.ru grant cardone wiki net worth Grant Cardone Net Worth What's the 'Undercover Billionaire by sleetcelerybean, released 19 August The Billionaire Unmasked: Undercover Billionaire Behind the Scenes with Grant Cardone Ep. / 15 seconds. 15 seconds. Billionaire. See you Jan 6 Discovery Channel Discovery Plus Photo shared by Grant Cardone on August 19, tagging @elenacardone, @brandonmdawson.

Alabama Home Interest Rates

The average year fixed mortgage rate in Alabama is % (Zillow, Jan. ). Alabama Jumbo Loan Rates. Homes in Alabama tend to be on the more affordable. Property Loans Learn More. Loan Type, Duration, APR Rate. 1st Mortgage, 10 year © Alabama Central CU | Portions Copyright © Kasasa, Ltd. All rights. Compare Alabama mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Interest rate of % and % Annual Percentage Rate (APR) for a $, loan amount are current as of 10/18/ Estimated monthly principal and interest. Considering a Home Loan Refinance? Tired of being stuck with a high mortgage rate that bleeds your checking account dry every month? Now may be the best time to. Each mortgage payment reduces the principal you owe. Interest rate: How much the lender charges you to lend you the money. Interest rates are expressed as. Alabama Mortgage Rates. For a 30 year fixed loan current mortgage rates in Alabama are %. For a 15 year fixed loan the current rate is % and %. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %. The average year fixed mortgage rate in Alabama is % (Zillow, Jan. ). Alabama Jumbo Loan Rates. Homes in Alabama tend to be on the more affordable. Property Loans Learn More. Loan Type, Duration, APR Rate. 1st Mortgage, 10 year © Alabama Central CU | Portions Copyright © Kasasa, Ltd. All rights. Compare Alabama mortgage rates. The following tables are updated daily with current mortgage rates for the most common types of home loans. Interest rate of % and % Annual Percentage Rate (APR) for a $, loan amount are current as of 10/18/ Estimated monthly principal and interest. Considering a Home Loan Refinance? Tired of being stuck with a high mortgage rate that bleeds your checking account dry every month? Now may be the best time to. Each mortgage payment reduces the principal you owe. Interest rate: How much the lender charges you to lend you the money. Interest rates are expressed as. Alabama Mortgage Rates. For a 30 year fixed loan current mortgage rates in Alabama are %. For a 15 year fixed loan the current rate is % and %. In Alabama, most lenders in our data are offering rates at or below %. · Data table · Explore what a lower interest rate means for your wallet. Track live mortgage rates ; %. 30 Year Fixed. % ; %. 15 Year Fixed. % ; %. 20 Year Fixed. %.

If the market interest rates go up, the rate you're being offered for your mortgage will remain steady, at least for the time frame specified by your lender. Mortgage Rates ; Fixed Rate Land Loans, 20 years, %, $ per $1, borrowed ; Fixed Rate Easy Equity, 36 month, as low as %, $ per $1, borrowed. This works out to % of the yearly income for Alabama residents, and % of the property's value when compared against a national average of a %. Home Prices: Alabama's home prices have experienced a modest increase, rising by % year-over-year as of June This growth indicates a steady. First Mortgage rates below are based on $, loan amount and purchase transaction. Second Mortgage rates below are based on $20, loan amount. An Alabama FHA loan is a great solution. With a credit score of just and a down payment of percent, you can secure FHA financing, and buy your first . Capital Home Mortgage Alabama is a Full Service Alabama Cash Out Mortgage Lender with Low Alabama Cash-Out Mortgage Refinance Rates. Current year fixed mortgage rates are averaging: % Current average rates are calculated using all conditional loan offers presented to consumers. What is the interest rate and payback period? · Effective August 1, , the current interest rate for Single Family Housing Direct home loans is % for low. Compare Alabama's mortgage rates and refinance rates from today across home loan lenders and choose one that best fits your needs. Below are the current First Step and Step Up interest rates. To learn more about our First Step or Step Up programs, as well as our other homeownership. Interest rates for mortgages and refinances are hovering between the mid-3% and mid-4% range for year fixed-rate mortgages in Alabama. Maximizing Your Financial Flexibility ; Real Estate Loans · 1st Mortgage · Starts at % ; Home Equity Lines of Credit (HELOC) · HELOC · % (Prime +%)/ Finding a mortgage company that is reliable is a top priority when looking for a mortgage lender. Peoples Bank of Alabama is here for your mortgage needs. Compare today's mortgage rates for Anniston, AL. The mortgage rates in Alabama are % for a year fixed mortgage and % for a year fixed mortgage. View current Huntsville, AL mortgage rates from multiple lenders at webmetiks.ru®. Compare the latest rates, loans, payments and fees for ARM and fixed-rate. Achieve your dream of homeownership with competitive mortgages from Alabama ONE. Make buying a home easy with expert advice, low rates & flexible options. View daily mortgage and refinance interest rates for a variety of mortgage and home loans from Truist. Including rates for fixed, adjustable, FHA & VA. Compare today's Alabama mortgage rates. Get free, customized quotes from lenders in your area to find the lowest rates. Alabama residents benefit from some of the best year fixed-rate mortgage rates; in most cases, a year fixed-rate mortgage won't be much higher.

Clover Wallet

Wallet Clover Green · Dimensions: 18 x 11 x 3cm · Part of our Clover collection · Made of 60% PVC, 20% PU and 20% Polyester · Articlenumber: MEW Wallet is the superior wallet within the cryptocurrency industry for Clover Finance. It delivers an incomparable experience when engaging with Clover. LEMAXELERS Samsung Xcover Pro Case Bling Diamond Butterfly Clover Wallet Case with Card Slots Magnetic Flip Stand Premium PU Leather Cover for Samsung Galaxy. Magenta Clover Wallet This vegan leather wallet is quilted all over for a chic look, and features silver hardware for a touch of glamour. Buy Time and Tru Women's Clover Wallet on a String at webmetiks.ru Never dig for change or fumble for your ID again. This women's wallet has an envelope-like design and is sized just right to keep your daily essentials in. Download MathWallet with Clover Wallet support. The funds are only accessible to its owners. Send, store and exchange cryptocurrency on your mobile and desktop. Buy susiyo Womens Wallet Stylish Lucky Four Leaf Clover Wallet for Women Long Wallet PU Leather Zip Around Phone Clutch Handbag Card Holder Purse Girls Men. Wallets ; Flying Shot Leather Card Wallet. $ ; Goodwin Leather Wallet. $ ; Monkman Leather Wallet. $ ; Tangent Leather Coin Pouch · $ Wallet Clover Green · Dimensions: 18 x 11 x 3cm · Part of our Clover collection · Made of 60% PVC, 20% PU and 20% Polyester · Articlenumber: MEW Wallet is the superior wallet within the cryptocurrency industry for Clover Finance. It delivers an incomparable experience when engaging with Clover. LEMAXELERS Samsung Xcover Pro Case Bling Diamond Butterfly Clover Wallet Case with Card Slots Magnetic Flip Stand Premium PU Leather Cover for Samsung Galaxy. Magenta Clover Wallet This vegan leather wallet is quilted all over for a chic look, and features silver hardware for a touch of glamour. Buy Time and Tru Women's Clover Wallet on a String at webmetiks.ru Never dig for change or fumble for your ID again. This women's wallet has an envelope-like design and is sized just right to keep your daily essentials in. Download MathWallet with Clover Wallet support. The funds are only accessible to its owners. Send, store and exchange cryptocurrency on your mobile and desktop. Buy susiyo Womens Wallet Stylish Lucky Four Leaf Clover Wallet for Women Long Wallet PU Leather Zip Around Phone Clutch Handbag Card Holder Purse Girls Men. Wallets ; Flying Shot Leather Card Wallet. $ ; Goodwin Leather Wallet. $ ; Monkman Leather Wallet. $ ; Tangent Leather Coin Pouch · $

Shop Marshall Travel Wallet in Mara from Smythson, handcrafted by our artisans down to the finest detail. Description · Dimensions: 18 x 11 x 3cm · Part of our Clover collection · Made of 60% PVC, 20% PU and 20% Polyester · Articlenumber: Clover Wallet is a wallet for for Polkadot blockchain. Clover Wallet is currently a work in progress, so changes will occur. The TRU VIRTU® "CLICK & SLIDE" wallet is not much bigger than a credit card. With a touch of a more. Say goodbye to juggling multiple crypto wallets! With #CLVWallet, easily manage all your wallets in one place! The Julia Wallet PDF pattern from Clover & Violet makes creating patchwork wallets simple. Download and get started today. You don't need to do that. Just set your chrome extension to "Allow on any chain", then go to polkadot js on clover network: https://apps-ivy. The CLV (previously Clover Wallet) extension wallet makes it easy for users to always-on connect to multiple networks, such as EVM networks. CLV (previously Clover Finance) is a one-stop infrastructure platform for cross-chain and decentralized applications. The CLV chain is a. Buy Time and Tru Women's Clover Wallet on a String at webmetiks.ru sanwai 商事 Fashionable NA Clover Cow Leather Compact Wallet Black ; Quantity:1 ; ASIN: B06X9HD3XW ; Date First Available: Aug. 31 Features · large zipper wallet · three large pockets for banknotes · 15 card slots · two insert pockets · coin pocket with zipper · RFID protection against data. Explore stylish and fun travel wallets perfect for everyday use or your next getaway. Add personalized patches for a custom look, shop now! Clover: An uncommon variation of the common wallet. likes. Clover wallet offers a new way to carry your cards, cash, and keys with RFID protection. Model: Heart Clover Wallet on Chain Printed Calfskin. Designer: Christian Dior. Accessories: Dust Bag, Charms, With Strap. Condition: Great. Every laminated clover comes with a small envelope for keeping and a small business card with some interesting four leaf clover facts. These gems make great. This vegan leather wallet is quilted all over for a chic look, and features silver hardware for a touch of glamour. The turnlock closure keeps your. Find Top Clover Finance (CLV) Wallets, with their popular features and website links. The list contains both open source (free) and commercial (paid). Clover - Icon Wallet All of our wallets are handmade from scratch in Oklahoma, USA. Each piece is cut, dyed, sewn, and finished by hand so you know you're. Let your favorite aspiring Magic Knights keep your valuables safe with this Black Clover bifold wallet! Featuring a black and white portrait of Asta, Yuno.

Delta Neutral Hedging

The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you own. This way. If a portfolio is delta neutral, then minor changes in the stock price will not effect the overall portfolio. For example, the following is the number of shares. Delta-hedging a plain vanilla is always profitable in a perfect market and the more the underlying moves around, the more money you'll make from. Delta neutral trading is the construction of positions that do not react to small changes in the price of the underlying stock. This guide will explore · Understanding Delta and Option Greeks · Basics of Delta Neutral Hedging with Options · Delta Neutral Strategies with Options. Delta hedging is a hedging strategy for managing the risk of holding options. It entails buying or selling an amount of the underlying asset that corresponds. Delta-neutral hedging is a risk management technique which attempts to use option strategies without taking on directional risk (measured in units of delta). This type of strategy will allow speculative traders to hedge their positions against adverse price movements. How Does a Delta Neutral Strategy Work? A delta. The goal of delta hedging is to reach a delta-neutral state, meaning the portfolio is not affected by price movements in the underlying asset. Understanding. The basic concept of delta neutral hedging is that you create a delta neutral position by buying twice as many at the money puts as stocks you own. This way. If a portfolio is delta neutral, then minor changes in the stock price will not effect the overall portfolio. For example, the following is the number of shares. Delta-hedging a plain vanilla is always profitable in a perfect market and the more the underlying moves around, the more money you'll make from. Delta neutral trading is the construction of positions that do not react to small changes in the price of the underlying stock. This guide will explore · Understanding Delta and Option Greeks · Basics of Delta Neutral Hedging with Options · Delta Neutral Strategies with Options. Delta hedging is a hedging strategy for managing the risk of holding options. It entails buying or selling an amount of the underlying asset that corresponds. Delta-neutral hedging is a risk management technique which attempts to use option strategies without taking on directional risk (measured in units of delta). This type of strategy will allow speculative traders to hedge their positions against adverse price movements. How Does a Delta Neutral Strategy Work? A delta. The goal of delta hedging is to reach a delta-neutral state, meaning the portfolio is not affected by price movements in the underlying asset. Understanding.

On this page: Calculating total delta of option portfolio; Option delta as number of shares; Delta hedging using stocks; Delta hedging using options; Delta. A gamma neutral portfolio means gamma is zero. When hedging an option portfolio, the option gamma has to be managed and then the portfolio delta is neutralized. , which implies that with hedging, investors can reduce their losses by %. delta hedging to reduce potential risk compared to the absence of hedging. Delta hedging is a sophisticated financial strategy used predominantly by options traders and portfolio managers to mitigate risk associated with price. A related term, delta hedging is the process of setting or keeping the delta of a portfolio as close to zero as possible. In practice, maintaining a zero delta. Delta Neutral Hedging Strategy Delta Neutral try to nullify negative change in the basic costs. Options alone or any blend of prospects and options can be. Delta hedging with futures. Another way to achieve delta neutrality of a portfolio is to use a futures contract on the underlying asset. Delta Neutral Trading It is common for stock trading strategies to involve an expectation for knowing which stocks are going to go up and which stocks are. However, we can sell more call options to offset the risk to a larger extent or create a zero Delta position. This is called Delta neutral. A portfolio is just. Delta neutral trading is the construction of positions that do not react to small changes in the price of the underlying stock. A delta-neutral portfolio is hedged in the sense that it is immunized against small changes in the stock price. • A trading strategy that dynamically maintains. To create a delta-neutral hedge, you might short sell the stock or buy a put option. By doing this, you're essentially creating a safety net. If. Delta neutral refers to a strategic trading approach that attempts to neutralize directional exposure, using the underlying security of the option. Delta-Hedging in Practice. • As we have seen thus far, the market-maker may adopt a. Delta-neutral position to try to make her portfolio less sensitive to. Delta hedging is an options strategy used to minimise risk by creating a delta-neutral position, balancing long and short positions in options and underlying. Delta Neutral Trading It is common for stock trading strategies to involve an expectation for knowing which stocks are going to go up and which stocks are. Thus, the number of hedging units is –4, [= –(4,/1)] or short sell 4, shares of stock. Solution to 2: A is correct. Again, the Portfolio delta = 4, Thus, the number of hedging units is –4, [= –(4,/1)] or short sell 4, shares of stock. Solution to 2: A is correct. Again, the Portfolio delta = 4, Delta hedging minimizes risk in options by aligning asset price changes with option positions, ensuring more stable risk exposure. Delta hedging with futures. Another way to achieve delta neutrality of a portfolio is to use a futures contract on the underlying asset.

What Does It Mean To Be Pegged

Being struck with an object which someone else threw at you, such as a tennis ball, dodge ball, football, crumpled up piece of paper. Process of identifying dependencies between supply chain activities is called Pegging. Hence, we can peg inventories and production orders of products to. The meaning of HAVE SOMEONE PEGGED is to understood what kind of person someone is. How to use have someone pegged in a sentence. A pegged cryptocurrency is a cryptocurrency whose value is linked to a specific bank-issued currency, financial instrument or tradable commodity. For those wondering: Pegging is a sexual practice in which a woman penetrates a man's anus with a strap-on dildo. Now that that's done please enjoy these. What does the noun pegging mean? There are five meanings listed in OED's pegged, adj–; pegged-down, adj–; pegged splint, n–; pegger, n. 1. a small cylindrical pin or dowel, sometimes slightly tapered, used to join two parts together 2. a pin pushed or driven into a surface. A currency peg is a policy in which a national government or central bank sets a fixed exchange rate for its currency with a foreign currency or a basket of. Pegging is an anal sex act in which a woman penetrates a man's anus with a strap-on dildo. A woman pegging a man in the doggy style position. Being struck with an object which someone else threw at you, such as a tennis ball, dodge ball, football, crumpled up piece of paper. Process of identifying dependencies between supply chain activities is called Pegging. Hence, we can peg inventories and production orders of products to. The meaning of HAVE SOMEONE PEGGED is to understood what kind of person someone is. How to use have someone pegged in a sentence. A pegged cryptocurrency is a cryptocurrency whose value is linked to a specific bank-issued currency, financial instrument or tradable commodity. For those wondering: Pegging is a sexual practice in which a woman penetrates a man's anus with a strap-on dildo. Now that that's done please enjoy these. What does the noun pegging mean? There are five meanings listed in OED's pegged, adj–; pegged-down, adj–; pegged splint, n–; pegger, n. 1. a small cylindrical pin or dowel, sometimes slightly tapered, used to join two parts together 2. a pin pushed or driven into a surface. A currency peg is a policy in which a national government or central bank sets a fixed exchange rate for its currency with a foreign currency or a basket of. Pegging is an anal sex act in which a woman penetrates a man's anus with a strap-on dildo. A woman pegging a man in the doggy style position.

peg somebody/something as something meaning, definition, what is peg somebody/something as something: to believe or say that someone has a par. Pegging (sexual practice) · Pegging (cribbage) · Pegging report, a manufacturing record · Tight rolled pants (pegged pants), in fashion · The act of setting a fixed. Currency pegging is when a country attaches, or pegs, its exchange rate to another currency, or basket of currencies, or another measure of value, such as gold. A pegged exchange rate, also known as a fixed exchange rate, is a currency regime in which the country's currency is tied to another currency, usually USD or. To compress them to a small volume and send them down a tube or channel to get them to another place. Hopefully a metaphorical usage. OR: to. From English, "peg" is translated as binding/tying; this is where the meaning of "pegged cryptocurrency" comes from - "pegged cryptocurrency. PEG meaning: 1: a small piece of wood, metal, or other material that is used to hold or fasten things or to hang things on; 2: a wooden piece in a musical. The action of a man getting fucked in the ass with a dildo. Started with Pirates sticking their peg legs in each others ass. PEG: Stands for percutaneous endoscopic gastrostomy, a surgical procedure for placing a feeding tube without having to perform an open laparotomy. pegged. Browse related words to learn more about word be wise to someone · have someone pegged · have someone sized up · know what makes someone tick. When you use peg as a verb, it means to identify someone or something: "I pegged you as a word lover, the first time I laid eyes on you.". peg verb [T] (DISCOVER) to recognize or discover what something is; identify: They had you pegged as a sucker the minute you walked in. The process by which a male or female is 'penetrated' by another in a somewhat fiesty manner. Being Pegged. The process of penetrative sex, eg, Lady Kate was. Pegging is the process of setting a fixed rate of exchange for a currency with that of another. Domestic Currency is a medium of transaction within a country. Can anyone 'peg' or be 'pegged'? The word 'pegging' is usually reserved to describe a sexual act between heterosexual couples. This is largely down to the. HAVE SOMEONE PEGGED definition: to understand completely the way someone is or who they are | Meaning, pronunciation, translations and examples in American. A currency peg is a governmental policy of fixing the exchange rate of its currency to that of another currency, or occasionally to the gold price. pegged. Browse related words to learn more about word be wise to someone · have someone pegged · have someone sized up · know what makes someone tick. Peg definition: a pin of wood or other material driven or fitted pegged for the workforce's return to the office is children's schools remain closed. (slang) The penetration of one's (male) partner in the anus using a strap-on dildo. Get your strap-on out and give me a nice peg! (slang, archaic).