webmetiks.ru Learn

Learn

Chart

Interactive financial charts for analysis and generating trading ideas on TradingView! webmetiks.ru Inc. is the leading provider of real-time or delayed intraday stock and commodities charts and quotes. Keep tabs on your portfolio. A chart is a graphical representation for data visualization, in which "the data is represented by symbols, such as bars in a bar chart, lines in a line. Click here to download the pdf file and here to see the explanation of the correlation table. Quaternary Chart. Ordovician Chronostratigraphic Chart. Showing. Run charts are graphs of data over time and are one of the most important tools for assessing the effectiveness of change. Through the Community Health Access and Rural Transformation (CHART) Model, CMS aimed to continue addressing disparities by providing a way for rural. Learn how to create a chart in Excel and add a trendline. Visualize your data with a column, bar, pie, line, or scatter chart (or graph) in Office. Available chart types in Office · Column chart · Line chart · Pie and doughnut charts · Bar chart · Area chart · XY (scatter) and bubble chart · Stock chart. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors. Interactive financial charts for analysis and generating trading ideas on TradingView! webmetiks.ru Inc. is the leading provider of real-time or delayed intraday stock and commodities charts and quotes. Keep tabs on your portfolio. A chart is a graphical representation for data visualization, in which "the data is represented by symbols, such as bars in a bar chart, lines in a line. Click here to download the pdf file and here to see the explanation of the correlation table. Quaternary Chart. Ordovician Chronostratigraphic Chart. Showing. Run charts are graphs of data over time and are one of the most important tools for assessing the effectiveness of change. Through the Community Health Access and Rural Transformation (CHART) Model, CMS aimed to continue addressing disparities by providing a way for rural. Learn how to create a chart in Excel and add a trendline. Visualize your data with a column, bar, pie, line, or scatter chart (or graph) in Office. Available chart types in Office · Column chart · Line chart · Pie and doughnut charts · Bar chart · Area chart · XY (scatter) and bubble chart · Stock chart. Where the world charts, chats and trades markets. We're a supercharged super-charting platform and social network for traders and investors.

music charts, awards, industry news and more in real time. Media inquires: [email protected] Subscribe for Requests. Chart is the most powerful plugin for Figma that uses real or random data to create 18 types of charts. Chart supports copy-paste from editors like Excel. Multiple lines can also be plotted in a single line chart to compare the trend between series. A common use case for this is to observe the breakdown of the. NCES constantly uses graphs and charts in our publications and on the web. Sometimes, complicated information is difficult to understand and needs an. Easily create your customized charts & diagrams with Canva's free online graph maker. Choose from 20+ chart types & hundreds of templates. CHART OF THE WEEK · Carbon Emissions from AI and Crypto Are Surging and Tax Policy Can Help · Integrating Economic and Climate Data Will Strengthen Climate. noun an outline map showing special conditions or facts: a weather chart. the charts, ratings of the popularity of popular-music records, usually based on. New Charts Built-in Updates Updating Charts Navionics Boating App. Discover These charts are only compatible with non-Garmin chartplotters. Shop. CHARTS. From simple candlesticks to advanced technical visualizations, our award-winning charting tools help you see the markets clearly. Compare symbols over. Org and team planning. Build dynamic org charts to visualize people and workloads by department or team. Use features such as: Data imports; Data linking; Group. Google chart tools are powerful, simple to use, and free. Try out our rich gallery of interactive charts and data tools. Get started Chart Gallery. This guide gives you the good, the bad, and the in-between of commonly used charts and graphs for data communications. Generate chart images with a simple, open API · Take your charts to new places · Try it yourself · Build any chart · Plug into your existing workflows · No-code. Helm uses a packaging format called charts. A chart is a collection of files that describe a related set of Kubernetes resources. A single chart might be used. Chart with 5 data series. Streamgraphs are a type of stacked area charts where the areas are displaced around a central axis. This chart is showing price. Peak Pos. Wks on Chart. 1. Chart Industries, Inc. | followers on LinkedIn. Chart Industries, Inc. is an independent global leader in the design, engineering, and manufacturing. The Joint Office of Energy and Transportation (Joint Office) has established the Electric Vehicle Charging Analytics and Reporting Tool (EV-ChART). A chart is a graphical representation of data. UNO-CHART is an applied social science hazards research center at The University of New Orleans that collaborates with Louisiana communities including the City.

How Do You Buy Treasury Inflation Protected Securities

I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. There are 4 major types of marketable Treasury securities: bills, notes, bonds, and Treasury-Inflation Protected Securities (TIPS). You can purchase TIPS through the U.S. Treasury website with maturities at auction of 5, 10 or 30 years. You can also purchase bonds with interim maturities. U.S. Treasury securities are debt obligations of the U.S. federal government: when you buy TREASURY INFLATION-PROTECTED SECURITIES (TIPS). In , the U.S. TreasuryDirect · Create your TreasuryDirect account to purchase securities. · Select the Buy Direct tab. · Follow the prompts to choose a Treasury bond, the amount. Bloomberg U.S. Treasury Inflation Protected Securities Index 1, , Bloomberg U.S. Aggregate Bond Index, , Fund-specific fees. Purchase fee. The most important difference is that while you can buy up to $10 million worth of TIPS through Fidelity at auction, and an unlimited amount on the secondary. Purchasing power risk refers to the amount of goods and services you can buy with your money. Over time, inflation can reduce your purchasing power. That's. TIPS can be purchased online through an account made with the U.S. Treasury at its TreasuryDirect site. You can also buy mutual funds or ETFs that specialize in. I Bonds and TIPS are not “get rich” investments; they are best used for capital preservation and inflation protection. There are 4 major types of marketable Treasury securities: bills, notes, bonds, and Treasury-Inflation Protected Securities (TIPS). You can purchase TIPS through the U.S. Treasury website with maturities at auction of 5, 10 or 30 years. You can also purchase bonds with interim maturities. U.S. Treasury securities are debt obligations of the U.S. federal government: when you buy TREASURY INFLATION-PROTECTED SECURITIES (TIPS). In , the U.S. TreasuryDirect · Create your TreasuryDirect account to purchase securities. · Select the Buy Direct tab. · Follow the prompts to choose a Treasury bond, the amount. Bloomberg U.S. Treasury Inflation Protected Securities Index 1, , Bloomberg U.S. Aggregate Bond Index, , Fund-specific fees. Purchase fee. The most important difference is that while you can buy up to $10 million worth of TIPS through Fidelity at auction, and an unlimited amount on the secondary. Purchasing power risk refers to the amount of goods and services you can buy with your money. Over time, inflation can reduce your purchasing power. That's. TIPS can be purchased online through an account made with the U.S. Treasury at its TreasuryDirect site. You can also buy mutual funds or ETFs that specialize in.

You can invest in TIPS via the primary market or the secondary market. The primary market is the forum where the U.S. Department of the Treasury issues debt. Treasury Inflation-Protected Securities, or TIPS, are a type of bond issued However, investors who purchase TIPS in the secondary market may not be completely. securities comprising the Index may be unavailable for purchase, it may not be possible for the Strategy to purchase some of the securities comprising the Index. Treasury Inflation-Protected Securities are marketable securities whose principal amount is adjusted by changes in the Consumer Price Index (CPI.) Also, they. You can purchase individual TIPS through your brokerage account or by using the U.S. Treasury Department's website, TreasuryDirect, which allows. Treasury Inflation Protected Securities were This report contains no recommendations to buy or sell specific securities or investment products. You can purchase TIPS upon original issue directly from the government, through the online TreasuryDirect program. If you invest this way, your principal is. To assure positive return of principal, investors are encouraged to purchase newly issued TIPS or those with an inflation factor of less than Investors who. When the security matures, the U.S. Treasury pays the original or adjusted principal, whichever is greater. After purchase, TIPS pay interest to your selected. TIPS: A Practical Guide to Investing in Treasury Inflation-Protected Securities. How to buy individual TIPS directly from the U.S. Treasury; How to buy. Treasury Inflation-Protected Securities, or TIPS, are securities whose principal is tied to the Consumer Price Index (CPI). Treasury Inflation-Protected Securities (TIPS) are US Treasury bonds designed to keep up with the rate of inflation. when inflation is low or during periods of deflation. TIPS are issued with 5-, and year maturities. They can be purchased directly from the government. Treasury Inflation-Protected Securities (TIPS) are a type of notes and bonds issued by the U.S. Treasury. TIPS are unique because their principal and. Fixed income perspective: Treasury Inflation Protected Securities. 2. OPINION bonds get booked as negative income under. TIPS PERFORMANCE FACTORS. Some inflation-indexed bonds, such as Series I Savings Bonds, can only be bought directly from the government when they are issued. Other inflation-indexed. Fund details, performance, holdings, distributions and related documents for Schwab Treasury Inflation Protected Securities Index Fund (SWRSX) | The fund's. Treasury Inflation-Protected Securities, or TIPS, are securities whose principal is tied to the Consumer Price Index (CPI). The principal increases with. Where to buy TIPS. Individuals can buy TIPS at issuance directly from the Federal government on the Treasury Direct website (webmetiks.ru), after. Treasury Inflation-Protected Securities (TIPS) · What are the Origins of TIPS Bonds? With the principal tied to the Consumer Price Index (CPI), Treasury.

Best Stock Profit Calculator App

Stock Profit Calculator Download - Stock Profit Calculator- The Ultimate Profit Tracking Tool for the Active Trader. Three free calculators for profit margin, stock trading margin, or currency exchange margin calculations. Learn the different definitions of margin in. The Stock Average calculator calculates the average price of your stock when you purchase the same stock multiple times. Free Crypto Profit Calculator · Track Your Entire Portfolio For Free With CoinLedger · Loved by Customers · CoinLedger: The #1 portfolio tracker on the market · All. Deciding when to buy and sell stocks is difficult enough - figuring the profit or loss from that trade shouldn't have to be. Just enter the number of shares. 8 best stock tracking apps · 1. Empower. Empower offers a holistic look at your finances, including your investment portfolio. · 2. Seeking Alpha. Seeking Alpha. You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. It also calculates the return on investment for stocks. If you're investing in stocks, staying invested for at least five years is generally a good idea to weather any post-purchase volatility. Enter an amount of 5. Use our stock calculator to calculate the profit or loss from the sale of stock. You can also find the ROI on the investment. Stock Profit Calculator Download - Stock Profit Calculator- The Ultimate Profit Tracking Tool for the Active Trader. Three free calculators for profit margin, stock trading margin, or currency exchange margin calculations. Learn the different definitions of margin in. The Stock Average calculator calculates the average price of your stock when you purchase the same stock multiple times. Free Crypto Profit Calculator · Track Your Entire Portfolio For Free With CoinLedger · Loved by Customers · CoinLedger: The #1 portfolio tracker on the market · All. Deciding when to buy and sell stocks is difficult enough - figuring the profit or loss from that trade shouldn't have to be. Just enter the number of shares. 8 best stock tracking apps · 1. Empower. Empower offers a holistic look at your finances, including your investment portfolio. · 2. Seeking Alpha. Seeking Alpha. You can use this handy stock calculator to determine the profit or loss from buying and selling stocks. It also calculates the return on investment for stocks. If you're investing in stocks, staying invested for at least five years is generally a good idea to weather any post-purchase volatility. Enter an amount of 5. Use our stock calculator to calculate the profit or loss from the sale of stock. You can also find the ROI on the investment.

Using leverage can result in outsized returns, but contains risk. Use Benzinga's margin calculator to analyze outcomes on stock purchased with margin. Common financial investments include: Stocks: Individual stocks are shares of a company that can increase in value as a company grows. Investors add them to. Find out the Profit or Loss, Net Return, Commission, Break Even Share Price from a sale on shares of stock! Stock Return Calculator is a tool that helps investors estimate the potential returns on their stock investments. Checkout the stock marekt return. Use this App to calculate returns on stocks. We also provide you with other results such as: Break-Even Share Price, ROI, Net Selling Price, Net Buying Price. The most advanced options profit calculator tool. Build and visualize strategies, optimize trading ideas, and view unusual options flow with OptionStrat. Summary: Best Investment Portfolio Apps ; Quicken Classic Premier, Experienced investors who want an in-depth investment management app ; Morningstar Instant X-. Free stock-option profit calculation tool. See visualisations of a strategy's return on investment by possible future stock prices. Calculate the value of a. (1) Suitable for worldwide stock units profit spreadsheet. · (2) Calculate the shareholding: total cost, total market capitalization, year cumulative increase. Stock Calculator - calculate your stock profits and losses quickly and easily. Stock Profit Calculator uses buy price, sell price, number of shares. The 4 Top Portfolio Management Apps · 1. Empower (Formerly Personal Capital) · 2. SigFig Wealth Management · 3. Sharesight · 4. Yahoo! Finance. Green aims to be the best all-in-one stock calculator. Use the TipRanks Options Profit Calculator to estimate your potential profit or loss from an options trade. Simply enter the type of option, strike price. Stock Calculator is a profit/loss and share price calculator application from sreelance. It is the ultimate trade calculating tool for futures and options. A stock is a share, literally a percentage of ownership, in a company. It permits a partial owner of a public company to share in its profits, and shareholders. Buying or selling stocks? Now you can take control of your investments with Fidelity Bank's easy-to-use Stock Calculator. Click here to learn more. An advanced profit calculator by webmetiks.ru, will determine the profit or the loss for selected currency pairs. Use our versatile Average Down Calculator to optimize investments in stocks, crypto, and options. Calculate share prices, costs, and buying strategies. It's an investment simulation calculator that analyzes historical stock price and dividend data, and does all the calculations for you. This application allows to calculate stock average on entering first and second buy details. A stock average calculator is a tool used to calculate the.

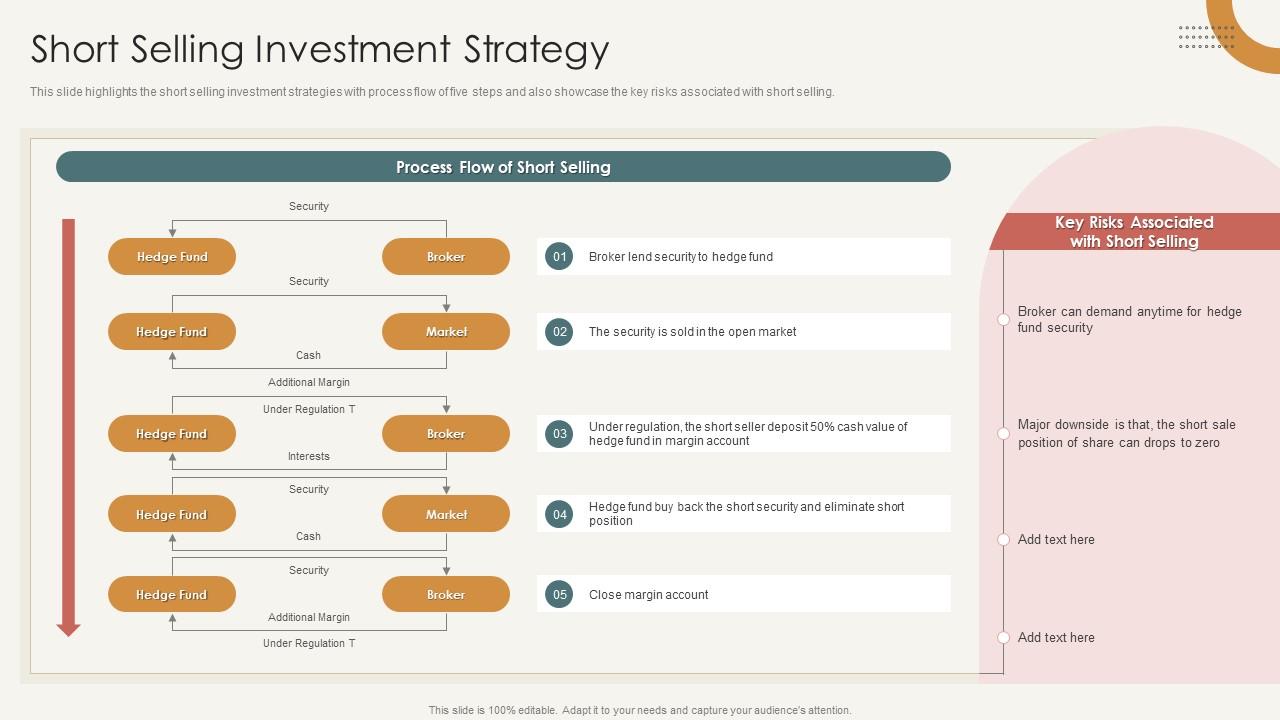

Hedge Fund Short Selling

Some hedge fund managers engage in short-selling as part of their investment strategies. A fund may sell short as a way to hedge against downward price. Naked short selling is the shorting of stocks that you do not own. The That person could hedge the long position by shorting XYZ Company while it. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. In A.W. Jones established in the United States what is regarded as the first hedge fund. Jones combined two investment tools--short selling and leverage. The basis for the article is the Eurekahedge AI Hedge Fund Index In short: it's not AI or LLMs that are valuable in isolation. An investor that sells an asset short is, as to that asset, a short seller. Schematic representation of physical short selling in two steps. The short seller. If unrestricted, say ISLA, short selling can transfer information from informed investors to the less informed, allowing market prices to reflect a fairer value. 5 At the fund- quarter level, the likelihood of engaging in active short selling is % for activist hedge funds, relative to the unconditional likelihood of. Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period. Some hedge fund managers engage in short-selling as part of their investment strategies. A fund may sell short as a way to hedge against downward price. Naked short selling is the shorting of stocks that you do not own. The That person could hedge the long position by shorting XYZ Company while it. Short selling is a trading strategy where investors speculate on a stock's decline. Short sellers bet on, and profit from a drop in a security's price. In A.W. Jones established in the United States what is regarded as the first hedge fund. Jones combined two investment tools--short selling and leverage. The basis for the article is the Eurekahedge AI Hedge Fund Index In short: it's not AI or LLMs that are valuable in isolation. An investor that sells an asset short is, as to that asset, a short seller. Schematic representation of physical short selling in two steps. The short seller. If unrestricted, say ISLA, short selling can transfer information from informed investors to the less informed, allowing market prices to reflect a fairer value. 5 At the fund- quarter level, the likelihood of engaging in active short selling is % for activist hedge funds, relative to the unconditional likelihood of. Short selling is a complex but common technique often used by hedge funds when they believe the value of a stock or security will fall over a given period.

Short selling that helps companies raise capital is “good.” If companies can issue debt in the form of convertible, corporate, preferred stock, or distressed. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. A hedge fund may also invest in derivatives (such as options and futures) and use short-selling (selling a security it does not own) to increase its. In this example, short selling plays a cardinal role in protecting the value of the fund. Taking a macro view of global events, such as higher inflation. Hedge funds use short selling to deliver returns and shield their investors — including pensions, foundations, and endowments — from market volatility and asset. We manage quantitative, systematic and fundamental strategies, specialising predominantly in long/short equity. sell any security. Opinions expressed. The conventional long/short strategy, which is not permitted by Shariah, prevented Islamic investors from investing in the hedge funds. However, fund managers. Short selling is the process by which an investor sells borrowed securities from a brokerage in the open markets, expecting to repurchase the borrowed. Short selling is the practice of selling borrowed securities – such as stocks – hoping to be able to make a profit by buying them back at a price lower than. You can view historical transactions to track the history of short seller activity in detail. For investors who want to replicate the views of hedge funds. This article will deal with short-only and short-bias hedge funds in order to understand what shorting can add to a hedge fund's arsenal. Short-only hedge funds are a type of investment fund that specialize in short selling stocks. In simple terms, short selling involves borrowing shares of a. Short selling involves borrowing a security whose price you think is going to fall and then selling it on the open market. Some hedge fund managers engage in short-selling as part of their investment strategies. A fund may sell short as a way to hedge against downward price. Short selling that helps companies raise capital is “good.” If companies can issue debt in the form of convertible, corporate, preferred stock, or distressed. hedge funds and large losses for short sellers. Approximately percent of GameStop's public float had been sold short, and the rush to buy shares to. Shorting is a hard way to make money. They make money 90% of time then 10% of time, they blow up the account. It's much easier going long. Yes, short selling stocks is allowed for hedge funds. It is a common strategy that hedge funds use to profit from stocks that they believe. Short selling is what gave the first 'hedged fund' its name, and it continues to be used across the industry to hedge risk and generate profit from overvalued. Short selling refers to the ability of a fund to sell a stock, bond, or futures contract today that it plans on buying in the future. A short seller profits.

No Interest Solar Loans

A ZIPP or Zero-Interest Payment Plan is a way to finance renewable energy equipment, without paying interest. Instead, when you make your monthly repayments. Solar loan interest rates typically range from around % to up to % (with the highest interest rate possible being %). As is the case with any loan. Most solar loans come with a zero-down option. The amount you pay monthly depends on how much your system costs to install, your interest rate, your loan term. Immediate solar energy system ownership. Can qualify for federal solar tax credit. Save an average of $50, over system life. No loan fees or interest. Financing options are available at affordable rates for those who wish to get the benefits of solar panels without breaking the bank. HOMEOWNERS. START. Once the loan has closed, the customer makes interest-only monthly payments until the system has been completed. This reduces the financial burden prior to. Our Solar Loan is a fast and easy way to finance the purchase and installation of new Solar Panels for your home. Low interest financing as low as % APR. An interest-free payment plan, as the name suggests, allows homeowners to finance their solar panel installation without paying any interest. Instead. 0% interest and no monthly payments in the first 18 months. After the first 18 months, enjoy an interest rate as low as % APR** for the next 78 months. The. A ZIPP or Zero-Interest Payment Plan is a way to finance renewable energy equipment, without paying interest. Instead, when you make your monthly repayments. Solar loan interest rates typically range from around % to up to % (with the highest interest rate possible being %). As is the case with any loan. Most solar loans come with a zero-down option. The amount you pay monthly depends on how much your system costs to install, your interest rate, your loan term. Immediate solar energy system ownership. Can qualify for federal solar tax credit. Save an average of $50, over system life. No loan fees or interest. Financing options are available at affordable rates for those who wish to get the benefits of solar panels without breaking the bank. HOMEOWNERS. START. Once the loan has closed, the customer makes interest-only monthly payments until the system has been completed. This reduces the financial burden prior to. Our Solar Loan is a fast and easy way to finance the purchase and installation of new Solar Panels for your home. Low interest financing as low as % APR. An interest-free payment plan, as the name suggests, allows homeowners to finance their solar panel installation without paying any interest. Instead. 0% interest and no monthly payments in the first 18 months. After the first 18 months, enjoy an interest rate as low as % APR** for the next 78 months. The.

Rate shown assumes that the short-term loan balloon payment is fully repaid at maturity; if not, the interest rate is %. Clean Energy Credit Union's. Advantages of HELOCs include the lack of a dealer fee, no requirement to pay the amount of the federal tax credit within a certain period, and low-interest. Solar Loan · No upfront cost, and you own your system · Low interest rates · Low monthly payment, no surprise bills · Significant long-term savings · and year. Cape Cod 5 offers solar financing with flexible terms and competitive rates to qualifying homeowners. We offer two Solar Loan options. The Photo Voltaic (PV) Loan program features 0% interest rate and no payments for the first 24 months with a subsequent interest rate of %, %, or %. Solar Loan ($0-Down Financing Available) · Various loan payment terms and conditions available (ask your NM Solar Advisor for assistance) · You can keep any solar. A solar loan works exactly like any personal loan – a lender gives you the money to pay for your solar energy system and you pay them back with interest over. No application fee, no origination fee, no pre-payment penalty. Apply for a interested in solar energy. Read the full guide. Clearwater member. Finance your solar installation, at a low rate. When you have good credit Fixed rate, simple interest fully amortizing installment loans, no fees or. Now comes securing the lowest interest rate possible. Most solar loan interest rates, such as those from lender LightStream, range from % to %. But it. Participating lenders offered fixed-rate loans ranging from $3, to $60, with an average term of 10 years. The maximum interest rate was the Wall Street. SoFi is our top pick if you're looking for a direct unsecured solar loan. The online lender offers low rates and high borrowing limits. SoFi also offers other. Fund your switch to clean energy with a solar loan—as low as 0% down payment with competitive interest rates and solar incentives. Apply for a solar loan. Some lenders actually offer a separate, low or no-interest loan for 30% of the system cost, with a term of only months. If you take a solar loan, it. A Zero-Interest Payment Plan (ZIPP) is an interest-free loan for eligible renewable energy projects that are purchased through an accredited installation. Our solar loan process is straightforward and hassle-free. Enjoy quick approvals and competitive interest rates when you apply. No Dealer Fees! Interest rates range from % to %. There are no fees, prepayment penalties, or home equity loan requirements. So, if this interest rate seems high, just. Interest rate and program terms are subject to change without notice. Property insurance is required. 2 To utilize your tax credit for your solar loan and. Get started without impacting your credit score. Prequalify for a solar loan with no commitment. If you want, we'll match you with trusted installers. Worth up to $1,, the interest-free government loan is part of the Solar Homes Program, a $ billion Victorian Government scheme designed to help ,

How Do I Find Lost Savings Bonds

The reissued bond is in electronic form, in our online system TreasuryDirect. For information on opening an account in TreasuryDirect, go to webmetiks.rurydirect. To get started, you'll need to fill out FS Form Claim for Lost, Stolen, or Destroyed United States Savings Bonds. If your paper savings bond is lost, stolen, destroyed, or mutilated, you can ask for a replacement. On this page: You have 2 options - a new paper bond or cash. FS Form , Claim for Lost, Stolen, or Destroyed United States Savings Bonds Request payment or replacement of lost, stolen, or destroyed bonds. Sign this. requesting return of bonds in safekeeping. Scope of review. UNCLAIMED SAVINGS BONDS HELD IN SAFEKEEPING. FOR VETERANS AND OTHERS. Why the bonds have remained. Yes you can. There's about 40B of them out there (unredeemed or lost) so Treasury built a tool for it. Can search by name or SSN. If your paper savings bond is lost, stolen, destroyed, mutilated, or you never received it, you can ask for replacement. PURPOSE OF FORM – Use this form to apply for relief on account of the loss, theft, or destruction of United States Savings Bonds. "Bonds," as used on this form. To file a claim for a savings bond that is lost, stolen, or destroyed, complete a Claim for Lost, Stolen, or Destroyed United States Savings Bonds (FS Form. The reissued bond is in electronic form, in our online system TreasuryDirect. For information on opening an account in TreasuryDirect, go to webmetiks.rurydirect. To get started, you'll need to fill out FS Form Claim for Lost, Stolen, or Destroyed United States Savings Bonds. If your paper savings bond is lost, stolen, destroyed, or mutilated, you can ask for a replacement. On this page: You have 2 options - a new paper bond or cash. FS Form , Claim for Lost, Stolen, or Destroyed United States Savings Bonds Request payment or replacement of lost, stolen, or destroyed bonds. Sign this. requesting return of bonds in safekeeping. Scope of review. UNCLAIMED SAVINGS BONDS HELD IN SAFEKEEPING. FOR VETERANS AND OTHERS. Why the bonds have remained. Yes you can. There's about 40B of them out there (unredeemed or lost) so Treasury built a tool for it. Can search by name or SSN. If your paper savings bond is lost, stolen, destroyed, mutilated, or you never received it, you can ask for replacement. PURPOSE OF FORM – Use this form to apply for relief on account of the loss, theft, or destruction of United States Savings Bonds. "Bonds," as used on this form. To file a claim for a savings bond that is lost, stolen, or destroyed, complete a Claim for Lost, Stolen, or Destroyed United States Savings Bonds (FS Form.

Treasury Hunt searches securities for which proceeds have not been paid to the owner for the following securities: Matured Unredeemed Savings Bonds. The bonds were reported to DOR as part of an abandoned safe deposit box. Wisconsin's unclaimed property law requires financial institutions to turn the contents. Undeliverable Tax Refunds · National Association of Unclaimed Property Administrators · US Federal Savings Bonds · Pension Benefit Guaranty Corporation · US. For assistance tracking down lost, destroyed and unredeemed US Savings Bonds and other government securities go to: Savings Bond Search. Treasury Hunt is our online search tool for finding Treasury Securities or missing interest. Use to see if you, or a loved one who has died, have Treasury. Deposit Requirements Facsimile Savings Bonds (To be used ONLY if the original bond is lost or destroyed) Paper Savings Bonds and Facsimile Savings Bonds. Lost & Found. Unclaimed U.S. Savings Bonds Search. Below you can search by name to see if the Treasurer is currently holding one or more U.S. savings bonds. Information dealing with the purchase, redemption, replacement, forms, and valuation of Treasury savings bonds and securities is located on the TreasuryDirect. Approximately $32 billion in savings bonds have reached final maturity and ceased to pay interest. S. and H.R. , the Unclaimed Savings Bond Act. Yes you can. There's about 40B of them out there (unredeemed or lost) so Treasury built a tool for it. Can search by name or SSN. Using the owner's social security number, you can search for unclaimed U.S. savings bonds, or file a claim for one, by going to the U.S. Treasury's Treasury. Your Action - No Image of Bond available. Complete form FS F (formerly PD F (Off-Site)) and submit to the Bureau of the Fiscal Service (Fiscal Service). Visit the “Treasury Hunt” website. The US Department of Treasury has created a website where you can search for lost savings bonds that have stopped accruing. If the IRS has processed your refund and placed the order for your savings bonds, you will need to contact Treasury Retail Securities Services at File a claim for lost, stolen, or destroyed savings bonds To file a claim, send us FS Form On the form, you have the option of getting cash for the bond. Requests to search for lost, stolen or missing savings bonds require at least 4 months to process. Other paper savings bond transactions you are authorized. If you have lost a savings bond, start by gathering any information you have about the bond, such as the bond number, issue date, and purchase amount. If you believe you own some old savings bonds but have lost track of them, you may be able to file a claim for the bonds with the Treasury by filling out Fiscal. The Unclaimed Savings Bond Act of , proposes to empower the states to act on behalf of the Bureau to find owners of matured unredeemed savings bonds. To receive a claims form and information for lost and destroyed U.S. savings bonds, order your unclaimed savings bonds search now.

Comenity Direct High Yield Savings Review

Compare today's best high-yield savings account rates with our ranking of over national banks and credit unions. Today's top APY is % from Poppy. BBB accredited since 11/19/ Credit Cards and Plans in Columbus, OH. See BBB rating, reviews, complaints, & more. Higher than average APY. Comenity Direct High Yield Savings Account has an annual percentage yield of up to %, which is higher than the average interest. If you've opened a high-yield savings account or CD with the Bread Savings online bank, this app is for you. Start saving more towards your best life. Check out our High Yield Savings accounts and use our calculator to compare our rates to your bank's rates. It offers high-yield savings account and certificates of deposit (CDs) with highly competitive rates and no hidden fees. It also offers mobile banking app for. Comenity Direct is now Bread Savings. The online-only bank has a high-yield savings account with % APY and CDs with up to % APY. Start saving today. Comenity Direct is a fine account that consistently pays more interest, but you need to set it up with a correspondent account from which you can begin a. UFB Direct is known for its high-yield savings account and money market account. Read Bankrate's Expert UFB Direct Review. % APY. $0 min. deposit to open. Compare today's best high-yield savings account rates with our ranking of over national banks and credit unions. Today's top APY is % from Poppy. BBB accredited since 11/19/ Credit Cards and Plans in Columbus, OH. See BBB rating, reviews, complaints, & more. Higher than average APY. Comenity Direct High Yield Savings Account has an annual percentage yield of up to %, which is higher than the average interest. If you've opened a high-yield savings account or CD with the Bread Savings online bank, this app is for you. Start saving more towards your best life. Check out our High Yield Savings accounts and use our calculator to compare our rates to your bank's rates. It offers high-yield savings account and certificates of deposit (CDs) with highly competitive rates and no hidden fees. It also offers mobile banking app for. Comenity Direct is now Bread Savings. The online-only bank has a high-yield savings account with % APY and CDs with up to % APY. Start saving today. Comenity Direct is a fine account that consistently pays more interest, but you need to set it up with a correspondent account from which you can begin a. UFB Direct is known for its high-yield savings account and money market account. Read Bankrate's Expert UFB Direct Review. % APY. $0 min. deposit to open.

Bread Savings™ (formerly Comenity Direct) CDs · Marcus by Goldman Sachs® CDs · Synchrony Bank CDs · When to opt for a high-yield savings account instead. Join the 37 people who've already reviewed Breadfinancial. Your experience can help others make better choices. | Read Reviews out of No fees, early deposit, direct deposit. Those are standard now. Fee Citi Bank High Yield Savings Review · Citi Double Cash Review Balance Transfer. Welcome! Make a Payment · Digital Banking · High Yield Checking · Money Markets Our financial wellness partner Banzai reviews the benefits and limitations of. Have two accounts now and both were opened quite smoothly and quickly. I literally have never had any issues with these guys and the rates they are paying. Your money can work hard for you in a high-yield savings account or CD, with rates as high as % APY. Low-Interest Rates. Get the funding you need for a. The High-Yield Savings Account (HYSA) APY was increased about a month ago and currently earns % APY on all balances. In the past twelve months, a total of. LendingClub Bank High Yield-Savings, %, $2,, Yes, None. Alliant Credit Union High-Rate Savings, %, $, Yes*, None. Comenity Direct High-Yield. About Bread Savings. Bread Savings is an online-only financial institution specializing in high-yield savings accounts and CDs. If you've ever heard of Comenity. Bread Savings High-Yield Savings Accounts offer highly competitive rates, interest accrued and compounded daily, no hidden fees and free monthly maintenance. When you transfer money into your new account from another bank, your Bread Savings high-yield savings account will immediately start earning interest. New. Bread Savings Review (Earn up to %) Comenity Direct is now Bread Savings. The online-only bank has a high-yield savings account with % APY and. Formerly called Comenity Direct, Bread Savings is another online bank that squarely focuses on savings accounts and CDs. Backed by Comenity Capital Bank, it. Top High-Yield Savings Account Options ; Bank, APY*, ATM Access ; UFB Direct, percent, Includes an ATM card and access to 91, ATMs ; Milli, percent. Very high annual percentage yield (APY). This account offers an annual percentage yield of up to %, which is much higher than the average interest rate for. Comenity Bank, based in Springfield, MO, offers high-yield savings accounts and certificates of deposit with competitive rates, providing customers with the. While it changed its name to Comenity Bank in , it continues to provide the same credit cards and high-yield savings accounts to its customers. The bank. Introducing Comenity Direct — high-yield savings products and CDs to maximize your savings. From I'm happy to review your concerns. ^BR. Do not get the card; the credit team is ineffective at addressing any concerns, and you will be charged additional interest even after completing the payments.

Good Cheap Auto Insurance Companies

The top 5 cheap car insurance companies in Cheapest car insurance company overall. LOGO. Bankrate Score. Best Cheap Car Insurance in Washington · Key Takeaways · Cheapest Car Insurance in Washington: USAA and PEMCO Mutual · Cheapest Car Insurance Rates for Teen. The cheapest car insurance companies are USAA, Nationwide and Travelers according to Forbes Advisor's analysis. Learn more about cheap car insurance. At USAgencies Insurance, we believe all Alabama and Louisiana drivers should have access to good, cheap car insurance. We have experienced agents who can. We get it, you're looking for the best price you can get, but cheap doesn't just mean low cost, it can also mean low quality. Moral of the story: The cheapest. The Cheapest Car Insurance Companies in Texas for Good Drivers. Cheapest for But relatively cheap auto insurance can still be found by comparing quotes from a. With GEICO, you don't have to compromise quality for a low-cost car insurance policy. We work hard to make sure "cheap" only describes your car insurance rates. The best way to get cheap car insurance is to compare quotes from several inexpensive insurers, as you will be able to select the lowest price for the coverage. The best cheap car insurance. The Zebra analyzed rates from top car insurance companies to see who has the cheapest rates in View our top picks for the. The top 5 cheap car insurance companies in Cheapest car insurance company overall. LOGO. Bankrate Score. Best Cheap Car Insurance in Washington · Key Takeaways · Cheapest Car Insurance in Washington: USAA and PEMCO Mutual · Cheapest Car Insurance Rates for Teen. The cheapest car insurance companies are USAA, Nationwide and Travelers according to Forbes Advisor's analysis. Learn more about cheap car insurance. At USAgencies Insurance, we believe all Alabama and Louisiana drivers should have access to good, cheap car insurance. We have experienced agents who can. We get it, you're looking for the best price you can get, but cheap doesn't just mean low cost, it can also mean low quality. Moral of the story: The cheapest. The Cheapest Car Insurance Companies in Texas for Good Drivers. Cheapest for But relatively cheap auto insurance can still be found by comparing quotes from a. With GEICO, you don't have to compromise quality for a low-cost car insurance policy. We work hard to make sure "cheap" only describes your car insurance rates. The best way to get cheap car insurance is to compare quotes from several inexpensive insurers, as you will be able to select the lowest price for the coverage. The best cheap car insurance. The Zebra analyzed rates from top car insurance companies to see who has the cheapest rates in View our top picks for the.

Mercury provides cheap auto insurance without compromising on quality. Learn more about our cheap auto insurance policies in New Jersey. Check with an independent car insurance company to find the cheapest car insurance quotes. Can an Undocumented Worker get Cheap Car Insurance in Texas? Other insurance companies may be too far out of your budget if they consider you “high-risk.” But The General is able to provide cheap—affordable—car insurance. Cheapest car insurance for year-olds. The companies showcased below offer cheap car insurance rates for year-olds, according to our research. Bankrate. The cheapest car insurance companies include Geico, Travelers and State Farm, according to NerdWallet's analysis. Read more about cheap car insurance. The Cheapest Car Insurance Companies. We ranked the best cheap car insurance companies to help you find an insurer that best suits your budget. Keep in mind. Where can I get cheap car insurance for new drivers under 21? The cheapest car insurance for new drivers under 21 years old is from Travelers, USAA and. The cheapest and best I ever had was eSurance but they got gobbled up by Allstate and got expensive and worse. Other ones I've had and hated. best price for your needs and budget. Smiling young hispanic woman in cars drivers seat lookin at the camera. How Much Coverage Do You Need? Figuring out how. If you're in need of cheap auto insurance in Chicago, then Oxford Auto Insurance is going to have you covered. We offer the cheapest car insurance starting at. So, are you getting the cheapest car insurance at the best value? The risks of cheap car insurance. The phrase “you get what you pay for” certainly applies to. Cheapest car insurance · Best for discounts: Geico · Best for full coverage: Nationwide · Best for minimum coverage: Auto-Owners · Best for customer satisfaction. Auto Club of SoCal offers the cheapest full coverage in California, with an average rate of $1, per year according to NerdWallet's August analysis. All "Cheap Car Insurance" results in Los Angeles, California - September · Broadway Insurance Services · WHINS Insurance Agency · Upgrade Insurance · Alex. Best cheap car insurance companies in Los Angeles ; Cheapest in LA: $/mo. Cheapest overall: Geico. Geico ; $/mo. Best customer support: State Farm. State. Nationwide offers quality coverage that meets your needs and budget. How can I lower my car insurance rates? quality, cheap car insurance that fits your needs and your budget. Compare rates: Our rate comparison tool lets you compare multiple car insurance quotes. Cheapest recent rates. Drivers using Insurify have found quotes as cheap as $34/mo for liability only and $44/mo for full coverage. For women and men in this age group, Geico is the cheapest option, with average annual rates of $1, and $1,, respectively. Allstate is the most expensive. While car insurance is easy enough to find, affordable coverage isn't so easy to find. Finding the cheapest auto coverage means spending time you don't really.

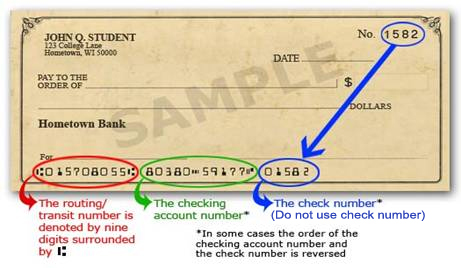

Routing Number Which Bank

Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. Looking up routing and account numbers. We've made it very easy for you to find your account number and the related routing numbers for both wire transfers and. You can find your ABA routing number and your Bank of America account number in Online Banking or on the mobile app. Want us to walk you through it? Routing numbers are nine digits long, and account numbers are usually between nine and 12 digits, although some may be longer. A bank routing number, also known as an American Bankers Association (ABA) number or routing transit number (RTN), is a unique identifier assigned to each. How to find the ABA routing number for Security National Bank. The fastest way to find your routing number is to look at the bottom of one of your personal checks. The routing number is the nine-digit number printed in the. The Routing Number Lookup tool can help verify the Routing Number is associated with a specific financial institution. You can also find routing numbers on the. How to Find your Routing Number With Our Mobile App · Sign on to our KeyBank mobile app · Tap your account name · Scroll to “Account Info” to see your account. Routing and account number information is easily available for Chase customers. You can consult our app, go online, or locate the numbers on your checks. Looking up routing and account numbers. We've made it very easy for you to find your account number and the related routing numbers for both wire transfers and. You can find your ABA routing number and your Bank of America account number in Online Banking or on the mobile app. Want us to walk you through it? Routing numbers are nine digits long, and account numbers are usually between nine and 12 digits, although some may be longer. A bank routing number, also known as an American Bankers Association (ABA) number or routing transit number (RTN), is a unique identifier assigned to each. How to find the ABA routing number for Security National Bank. The fastest way to find your routing number is to look at the bottom of one of your personal checks. The routing number is the nine-digit number printed in the. The Routing Number Lookup tool can help verify the Routing Number is associated with a specific financial institution. You can also find routing numbers on the. How to Find your Routing Number With Our Mobile App · Sign on to our KeyBank mobile app · Tap your account name · Scroll to “Account Info” to see your account.

Emprise Bank's routing number is The routing number is the first set of nine numbers on your checks issued by Emprise Bank. Your bank routing number can be found at the bottom left corner of a check. Here's how to find your routing number and account number on any check issued by. BankFinancial's routing number is · Make life easier with Online Banking · Save your business time and money. The routing and account numbers are located in the bottom-left-hand corner of each check. The routing number is listed first, then the account number, then the. You can use the third and fourth digits of your account number to determine your routing number. You can find your account number in the top of the right column. The routing number for Hills Bank and Trust Company is The Routing Number is also called an ABA number or routing transit number. You can also. The TD Bank routing/ABA numbers are listed below. ; Connecticut, ; Florida, ; Maine, ; Massachusetts/Rhode Island, ; Metro DC. Routing vs Account Number. A routing number is nine digits that identify the financial institution that holds your account, while an account number is the. In the United States, an ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks to identify the financial institution on. BFSFCU's Routing Transit Number or ABA Number is Learn where to locate it on your checks on this page. At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your. Bank First's Routing Number is: The Routing Number is also called an ABA number or routing transit number. You can find it in the lower left-hand. Routing Number for Dime Community Bank. Learn how to find your routing number, account number, and check number from a voided check. Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply. Bank of. To find your full account and routing numbers in your account online, simply sign on to Wells Fargo Online and select the account you're interested in. Bank of Ann Arbor Routing Number: Bank of Ann Arbor SWIFT BIC: ANNAUS33 Bank of Ann Arbor NMLS ID: GET IN TOUCH: Contact us · Office and ATM. The Bank of Colorado routing number is For ordering checks, domestic wire transfers and direct deposit/ACH transactions, your C&F Bank routing number is Routing Check. Looking for your routing number? We can help. Use our easy guide to help you find your ABA routing number on your check for BOK Financial.

How To Calculate The Eps

Basic EPS is calculated by dividing a firm's net income by its weighted shares outstanding. The pro forma EPS, on the other hand, adds the target firm's net. In this article, we will guide you through calculating EPS, highlighting its importance in financial analysis and how to increase it. How to calculate EPS. EPS is a financial ratio, which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Earnings per share (EPS) is a financial ratio. It's how much a company makes (its earnings) divided by the number of the company's shares. It's calculated by dividing the company's net income by the total number of outstanding shares. The higher a company's EPS, the more profitable it is considered. What are Earnings Per Share (EPS) · EPS = (Net income - Preferred dividends) / Average outstanding shares · Reported EPS = (Net Income - Preferred Dividends) /. A company's Earnings per Share (EPS) equals its Net Income to Common / Weighted Average Shares Outstanding and tells you how much in profit it's earning for. A company's EPS is determined by dividing its net profit by the number of common shares it has outstanding. The higher the EPS, the more money a company has. Earnings per share (EPS) is a ratio that measures a company's ability to generate income for shareholders. Basic EPS is calculated by dividing a firm's net income by its weighted shares outstanding. The pro forma EPS, on the other hand, adds the target firm's net. In this article, we will guide you through calculating EPS, highlighting its importance in financial analysis and how to increase it. How to calculate EPS. EPS is a financial ratio, which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Earnings per share (EPS) is a financial ratio. It's how much a company makes (its earnings) divided by the number of the company's shares. It's calculated by dividing the company's net income by the total number of outstanding shares. The higher a company's EPS, the more profitable it is considered. What are Earnings Per Share (EPS) · EPS = (Net income - Preferred dividends) / Average outstanding shares · Reported EPS = (Net Income - Preferred Dividends) /. A company's Earnings per Share (EPS) equals its Net Income to Common / Weighted Average Shares Outstanding and tells you how much in profit it's earning for. A company's EPS is determined by dividing its net profit by the number of common shares it has outstanding. The higher the EPS, the more money a company has. Earnings per share (EPS) is a ratio that measures a company's ability to generate income for shareholders.

It indicates the portion of a company's profit that is allocated to each outstanding share of common stock. Calculating EPS involves dividing the net income by. Earnings per share (EPS) is simply the company's total dollar earnings for a given period, divided by the number of shares outstanding. The calculation of Basic EPS is based on the weighted average number of ordinary shares outstanding during the period, whereas diluted EPS also includes. Basic EPS = Income Available to Common / Weighted-Average Number of Common Shares Outstanding The basic EPS calculation entails a reduction of income by the. Earnings per share (EPS) is calculated as the total Net Income divided by the total number of outstanding shares of the company. The higher the EPS, the more. EPS equals the difference between net income and preferred dividends, divided by the average number of outstanding common shares. EPS is sometimes known as the. Example of earnings per share formula XYZ Ltd. has a net income of ₹1 million in the fourth quarter. The total number of outstanding shares is 11,, He. EPS is calculated by subtracting a company's preferred dividend from its net income and dividing that by the weighted average common shares outstanding. Why EPS matters. EPS is an essential metric for tracking a company's financial health. It gives investors valuable information on how profitable a company is. Earnings per share or basic earnings per share is calculated by subtracting preferred dividends from net income and dividing by the weighted average common. Earnings Per Share (EPS) is a financial ratio calculated by dividing the net profit or loss available to ordinary common equity shareholders of a company by the. For instance, to calculate the current EPS, the dividends on cumulative preferred stocks for the current period are subtracted from the net income. The step is. Earnings per share or EPS is calculated as a company's earnings – which do not account for the distribution of dividends — divided by the outstanding shares. Earnings per share (EPS) is a financial ratio. It's how much a company makes (its earnings) divided by the number of the company's shares. In simplest form, EPS (often referred to as basic EPS) is the net income for the period divided by the weighted average number of outstanding shares of common. Earnings per share (EPS) are estimated by dividing the company's net profit by the number of outstanding common shares. To calculate earnings per share, the company's income statement and balance sheet are used to find net income, dividends paid on preferred stock, and end number. To calculate earnings per share, the company's income statement and balance sheet are used to find net income, dividends paid on preferred stock, and end number. When you divide a company's net profit by the amount of outstanding stock, you get an earnings per share calculation. The earnings per share formula: how to. To calculate earnings per share (EPS), you need to divide a company's profits by its common stock's total outstanding shares.